Comments and Opinions

Simply put, the Second Quarter of 2022 was painful. Painful for stock markets, investors, consumers, and the US economy in general. The Federal Reserve continued to raise interest rates in an effort to tame inflation, supply chain issues lingered, and stocks entered bear market territory. The question of whether the US is in recession after experiencing two consecutive quarters of declining Gross Domestic Product was debated by politicians, economists, and the public in general.

Stock market performance came close to historical lows. The Dow Jones Industrials were down -10.8% in the second quarter, -14.4% year to date. The S&P was down -16.1% in quarter two, -20.0% ytd, and the Nasdaq Composite finished the quarter down -22.3%, -29.2% ytd. Source: NASDAQ Inc. 2022

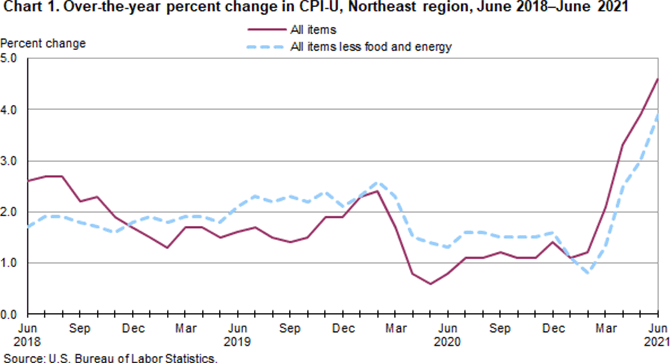

Inflation continues to be a major problem throughout the US and the world as we experience the highest inflation rates in over 40 years. During the Covid recession in 2020, inflation affected targeted products, such as cars, due to demand vs. inventory. However, as consumer demand returns to previously normal levels inflation has increased and persisted for basic goods such as energy, gasoline, food, rental housing, and mortgage rates.

A slowdown in growth is expected due to tightening monetary policy. The Federal Reserve recently raised interest rates by 75 basis points, (.75%), the biggest single increase since 1994—and signaled more big hikes to come—in its continued effort to tame the highest inflation the U.S. has seen in 42 years. Source: Morgan Stanley

With uncertainty in the foreseeable future, we recommend a review of your investment portfolio to determine if the asset allocation, diversification, and risk category meet your current financial goals.

Women and Investing

The US Census Bureau’s report dated March 2, 2022 reports women outnumber men 51% to 49%. Approximately $30 trillion in wealth is set to change hands in the next decade and women will inherit a sizable share, according to research by McKinsey & Company published in 2020. However, unique issues face women relating to money and investing. The possibility of leaving the workforce for extended periods to care for family members, the ever-increasing expense of childcare, the reality of the gender pay gap, underrepresentation in executive positions, and a lack of any significant financial education in public schools are just some of these issues.

However, according to Fidelity’s Women & Investing Study, 2021:

67% of women are now investing in addition to their retirement accounts compared to 44% in 2018. Millennial women lead the way with 71% investing outside of their retirement accounts. Although these are positive trends, women are significantly behind men in actual dollars invested. This is concerning because women tend to live longer than men and therefore their savings will need to last longer. Obtaining investment knowledge will increase confidence and help women become more successful in reaching their financial goals.

Steps to take may include:

- Put your finances in order by developing a budget, take steps to pay off debt, and establish an emergency account.

- Set your financial goals for short-term and long-term horizons.

- Determine your risk suitability and risk tolerance.

- Take full advantage of your employer’s retirement plan if offered.

- Keep emotions out of investment decisions and behavior.

- Consult a qualified financial advisor.

The information and opinions expressed herein have been obtained from sources believed to be reliable but are not guaranteed for accuracy or completeness; are for information/educational purposes only; do not constitute a solicitation or recommendation for the purchase or sale of any security; are not unbiased/impartial; subject to change; may be from third parties. Opinions expressed are those of the Author and do not necessarily reflect those of B. Riley Wealth Management or its affiliates. Investment factors are not fully addressed herein.

Securities and variable insurance products offered through B. Riley Wealth Management, Inc., member FINRA/SIPC. Fee-based advisory services offered through B. Riley Wealth Advisors, Inc., a SEC-registered investment adviser. Fixed insurance products offered through